Content

This allows others within the business to understand those projections’ potential impacts in relatable terms. Businesses must account for overhead carefully, as it has a significant impact on price-point decisions regarding a company’s products and services.

Accounts payable and accounts receivable are accrual types. Examples include bank loans, unpaid bills and invoices, debts to suppliers or vendors, and credit card or line of credit debts.

The Beginner’s Guide to Bookkeeping

The Full Disclosure Principle requires accountants to disclose relevant financial information to any interested parties, particularly investors and lenders. This information must be disclosed either in the body of a financial statement, or in the notes at the end of that statement. It may be helpful to think of the balance equation in terms of a company’s assets being equal to the company’s liabilities plus the owner’s/shareholder’s equity. In other words, accounting for beginners what you have is always determined by what you owe plus what is currently yours to keep. As you study financial statements, you should aim to be able to create them on your own and be able to identify what all of the numbers on a certain statement mean. Visit your local library to find books on accounting, or purchase a book from the bookseller of your choice. We will present the basics of accounting through a story of a person starting a new business.

Accounting concepts build on one another, so investing time in deeply understanding each one before moving on will build a strong foundation for learning more advanced principles. It can be tempting to rush through to more complex topics, but putting the time in early will pay off. The income statement, also called the profit and loss statement, or P&L, shows your organization’s revenue, expenses, and profit, typically on a quarterly or annual basis.

47m of online video course

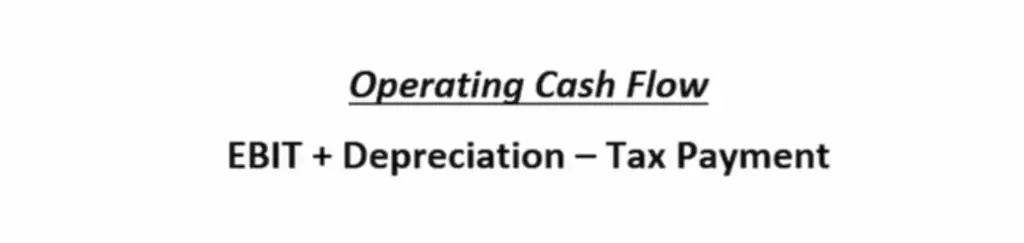

DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. A very informative and relevant book that takes an interesting approach to account. The author aims to focus on the accountants, bookkeepers, and business students as it provides perfect examples and material for referring.

- Double-entry systems add assets, liabilities, and equity to the organization’s financial tracking.

- Accounting is a comprehensive system to collect, analyze, and communicate financial information.

- Very small firms may use a basic spreadsheet, like Microsoft Excel.

- However, when liability accounts, like accounts payable, are debited, they decrease.

- The Purchases account on the chart of accounts tracks goods purchased.

- It’s a top hedgefund investor who explains accounting/finance in basic terms in under an hour.

Please note the information contained within this document is for educational and entertainment purposes only. All effort has been executed to present accurate, up to date, reliable, complete information. Readers acknowledge that the author is not engaging in the rendering of legal, financial, medical, or professional advice. The content within this book has been derived from various sources. Please consult a licensed professional before attempting any techniques outlined in this book. This will be found at the bottom of the income statement.

Tax Accounting

If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. We accept payments via credit card, wire transfer, Western Union, and bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. Cash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

Small Business Bookkeeping Guide – Forbes

Small Business Bookkeeping Guide.

Posted: Thu, 15 Sep 2022 07:00:00 GMT [source]

Because of this, many publicly-traded companies report both GAAP and non-GAAP income. Sometimes this extra data can help the public image of a company or clarify the value of a company’s investments. Liabilities are everything that your company owes in the long or short term. https://www.bookstime.com/ Your liabilities could include a credit card balance, payroll, taxes, or a loan. Accruals are credits and debts that you’ve recorded but not yet fulfilled. These could be sales you’ve completed but not yet collected payment on or expenses you’ve made but not yet paid for.